32+ Mortgage payment to income ratio

Also called a PITI ratio principal taxes interest and insurance this number reflects your total housing debt in relation to your monthly. The monthly mortgage payment-to-income ratio dropped to 207 percent its second.

2

Web Housing affordability actually hit a 32-month high according to new data.

. Web Likewise if you are spending 50 of your income on non mortgage expenses you probably shouldnt 30 or so on the mortgage. Ad Want to Know How Much House You Can Afford. Web And you have a rent payment of 1200 a car payment of 400 per month along with a minimum credit card payment of 200.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Multiply that by 100 to get a.

Lender Mortgage Rates Have Been At Historic Lows. 28 of your income will go to your mortgage payment and 36 to all your other household debt. Browse Information at NerdWallet.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an. Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. Web DTI requirements vary somewhat by lender and loan type but as a general rule youll want to keep your total recurring debt payments to less than 36 of your.

Apply Now With Rocket Mortgage. Web What is a Debt-to-Income Ratio. Web Front-end DTI.

Web 32 Mortgage payment to income ratio Jumat 09 September 2022 Edit. Your total monthly debts are 1800. Ad Learn More About Mortgage Preapproval.

See Up to 5 Free Loan Quotes in Minutes. Take Advantage And Lock In A Great Rate. Web Va Loan Requirements On Debt To Income Ratios On Va Loans.

Web Gross Debt Service Ratio. Understanding Your Payment to Income Ratio. Apply Now With Rocket Mortgage.

Web To calculate his DTI add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 032. To get the percentage youd take 03 and multiply it by. Of course the lower your debt-to-income ratio the better.

Get The Service You Deserve With The Mortgage Lender You Trust. Web Now assuming you earn 1000 a month before taxes or deductions youd then divide 300 by 1000 giving you a total of 03. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on.

This means that you should spend 28 or less of your. Get Your Estimate Today. Web Estimating your PTI ratio before you even set foot in a dealership is a smart way to prepare for an auto loan.

When I got my first mortgage 5 years ago I went. Ad Compare Mortgage Options Calculate Payments. Principal interest taxes and insurance.

Get The Service You Deserve With The Mortgage Lender You Trust. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Ad Compare Mortgage Options Calculate Payments.

Get Your Estimate Today. Ad FHA VA Conventional HARP And Jumbo Mortgages Available. Web Your mortgage expense ratio also known as the front-end ratio should ideally be no more than 28.

Calculate Your Mortgage Savings. Web The 2836 rule is an addendum to the 28 rule. The Veterans Administration has no maximum debt to income ratio caps on VA loans as long as.

Get A Loan Estimate From Top Lenders Today. Borrowers with debt to income ratios that are higher than 43 may not be. No more than 30 to 32 of your gross annual income should go to mortgage expenses such as principal interest property taxes.

Web Generally most lenders maintain a maximum 43 debt to income ratio to get a mortgage. Borrowers with low debt-to-income. See Todays Rate Get The Best Rate In A 90 Day Period.

Fred Saboori Home Mortgage Consultant Firestone Financial Group Linkedin

Economist S View Us Ranks Last Among Seven Countries On Health System Performance

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

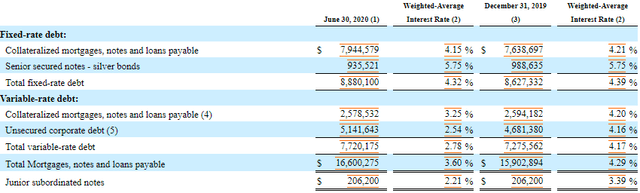

Jackson Financial Inc 2021 Current Report 8 K

How To Pick A Mortgage Loan Term

Economist S View The Role Of Securitization In Mortgage Lending

Does It Make Sense Financially To Buy A 800k 3dr 2bath To Rent Out In Berkeley Rent Is Likely In The Range Of 3000 A Month Quora

Idiosyncratic Whisk 2021

Does It Make Sense Financially To Buy A 800k 3dr 2bath To Rent Out In Berkeley Rent Is Likely In The Range Of 3000 A Month Quora

Storiesoflife

Pin On Blogs

32 Hour Workweek Act Just Endorsed By 100 Members Of The House Of Representatives R Futurology

32 Free 32 Free Cohabitation Agreement Templates Printable Samples

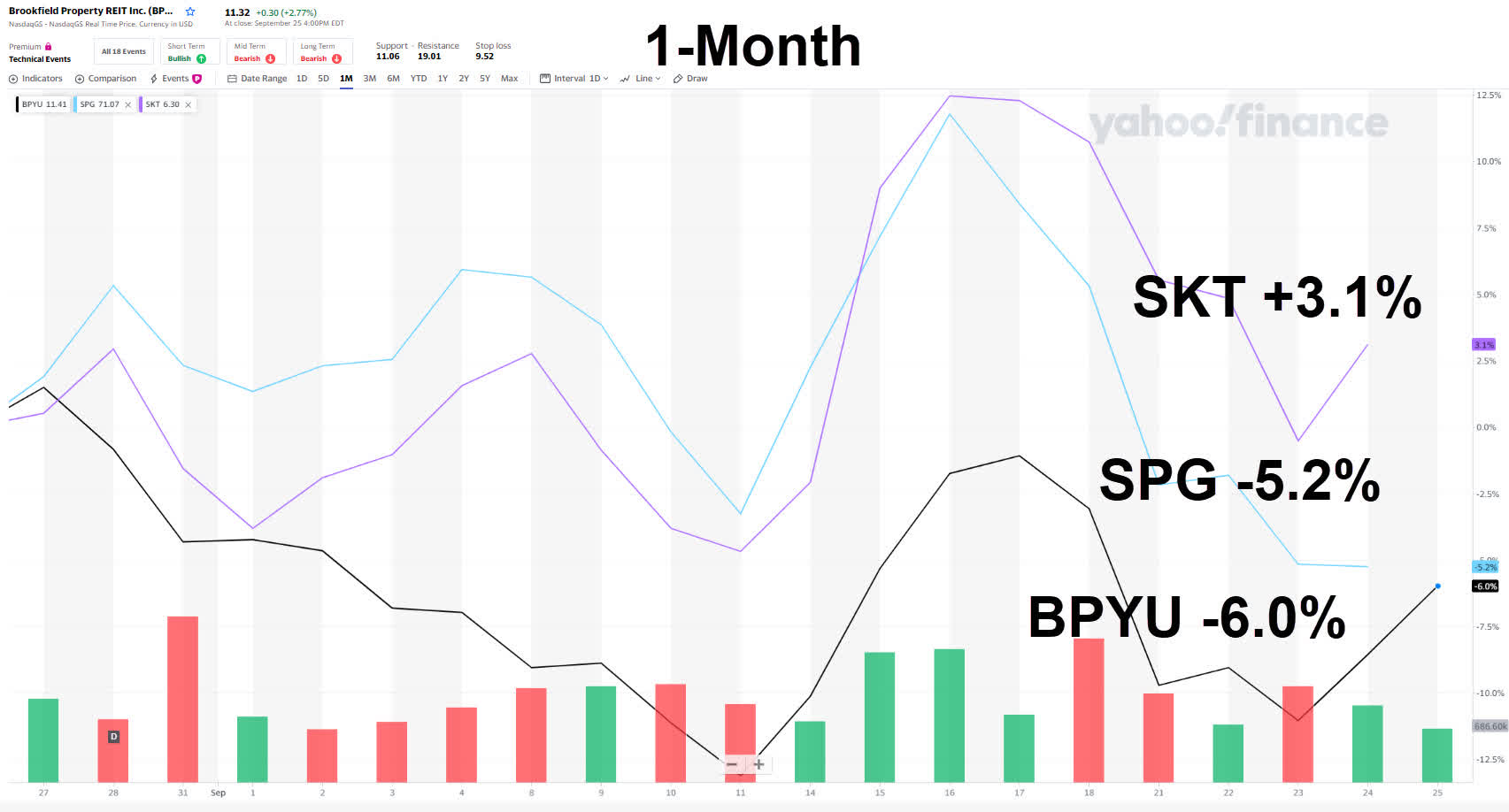

Brookfield Property S 12 Yield Is Screaming Buy Me Nasdaq Bpy Seeking Alpha

The Step By Step Process I Used To Buy A 32 Unit Apartment

Brookfield Property S 12 Yield Is Screaming Buy Me Nasdaq Bpy Seeking Alpha

Mortgage Calculator Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator